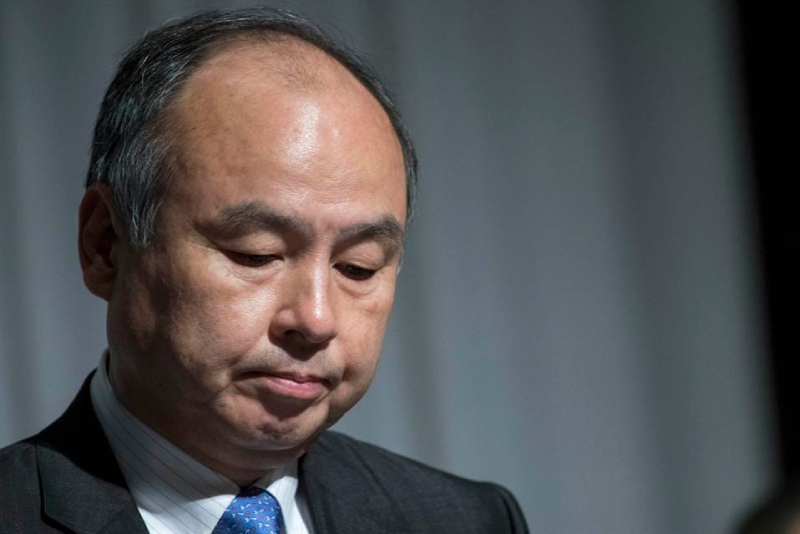

SoftBank Group Corp. and its founder, Masayoshi Son, have long been known for their willingness to take big bets on startups in the hopes of finding the next big thing. Over the past five years, SoftBank and its Vision Funds have invested nearly $140 billion in almost 400 startups in the belief that at least one will be successful enough to offer a sizeable return to investors. However, recent reports suggest that this strategy may be running out of steam.

Net losers

According to a recent earnings announcement, the Vision Funds dropped a combined $5 billion in the December quarter, making them net losers since inception. Son’s first Vision Fund, launched in 2017, is up $11 billion on investments of $89.6 billion, a modest 12% gain. However, the Vision Fund 2, which started two years later, is down $16.7 billion on $49.9 billion of acquisitions. Worse still, while SoftBank Group holds only a third of the better-performing first fund, it owns almost the entirety of the latter.

This puts Son and SoftBank’s management team in a bind. The first Vision Fund is due to expire in just six years, while the second fund has an extra three years to find some winners. That’s not a lot of time for this basket of investments to hit stratospheric valuations and provide better returns than an investor could get from sticking their money in an S&P 500 ETF.

Admittedly, the second Vision Fund has around $6.5 billion left to spend, and Vision Fund Chief Financial Officer Navneet Govil has said that the group could add more money to the fund or open yet another. But starting its fourth fund in barely six years—three Vision Funds plus its smaller LatAm Fund—sounds like an inveterate gambler convinced his next pony will be the one that makes him rich.

Current strategy

The strategy has worked so far, with $4 billion of buybacks in the December period helping the shares climb 15% for the best quarter in almost two years. Last month, the company announced plans to cancel 14.7% of shares by the end of this quarter. More may be on the way: In January, it filed to sell ¥1.5 trillion ($11.5 billion) in bonds.

That’s not to say the bet will pay off. All the other businesses could remain a drag on sentiment given the many headwinds facing the domestic economy. The telecom unit continues to suffer from declining tariffs, ad growth at internet properties Line and Yahoo Japan will be a struggle given Tokyo’s monetary policy environment, and investors may prefer to shift their focus to companies that are more likely to benefit from rate tightening, such as financials and defensives including food.

Almost depleted

The Vision Funds are largely exhausted, and management has limited power over when portfolio companies exit—whether by public offering or takeover. To be sure, SoftBank is more than just a venture capital business. It’s a major owner of telco SoftBank Corp. and remains a significant shareholder in Alibaba Group Holding Ltd., but it cannot do much more than ride the ups and downs of both companies.

Despite the challenges, SoftBank remains a major player in the tech investment space, and it would be premature to write off its Vision Funds entirely. However, the company may need to adjust its strategy if it wants to maintain its position as one of the world’s leading tech investors.

What’s next?

One possible approach is to focus more on early-stage investments, where the company has had some success in the past. SoftBank’s early investments in Alibaba and Yahoo Japan, for example, have proven to be highly profitable. By investing in smaller companies earlier on, SoftBank may be able to avoid some of the issues that have plagued its larger investments.

Despite the setbacks that SoftBank has faced with its Vision Funds, the company is not giving up just yet. In fact, Son has indicated that he has one big bet left in him. SoftBank’s next move will be crucial, not just for the company, but for the broader tech industry as well.

The problem with SoftBank’s Vision Funds is that they have been largely focused on late-stage startups, meaning that the company has missed out on many of the biggest winners in the tech industry. By the time SoftBank invests in a company, it is often already valued at billions of dollars. This has made it difficult for the company to generate meaningful returns for its investors.

Correcting steps

However, SoftBank’s latest investment strategy suggests that the company is trying to correct this problem. Rather than investing in late-stage startups, SoftBank is now looking to invest in early-stage companies. The company recently launched a new $100 million fund, called the SoftBank Opportunity Fund, which is focused on investing in startups owned by people of color.

This new fund represents a shift in strategy for SoftBank, as it seeks to identify promising startups at an earlier stage. By investing in startups that are still in the early stages of development, SoftBank hopes to capture more of the upside potential of these companies. If SoftBank is successful in this new strategy, it could help to restore the company’s reputation as a savvy tech investor.

Another area where SoftBank is investing heavily is in the semiconductor industry. SoftBank is currently in the process of acquiring ARM Holdings, a UK-based semiconductor company, in a deal worth $40 billion. This acquisition would give SoftBank a foothold in the semiconductor industry, which is expected to be a key driver of growth in the tech industry over the next decade.

SoftBank is also exploring the possibility of launching a new fund focused on the semiconductor industry. The company has reportedly been in talks with potential investors about a new fund that would invest in semiconductor companies at an early stage. If SoftBank is successful in launching this new fund, it could give the company a significant advantage in the semiconductor industry.

Next bet

Despite the challenges that SoftBank has faced with its Vision Funds, there is reason to believe that the company could still be a major force in the tech industry. With its new investment strategy focused on early-stage startups and its aggressive moves in the semiconductor industry, SoftBank is positioning itself for long-term success.

Of course, there are still many challenges that SoftBank will need to overcome if it wants to be successful. The tech industry is notoriously difficult to predict, and even the most savvy investors can be caught off guard by unexpected shifts in the market. However, if SoftBank can continue to make smart investments and stay ahead of the curve, it could be a major player in the tech industry for years to come.

Masayoshi Son may have one big bet left in him, but that bet could be a game-changer for the tech industry. SoftBank’s recent moves suggest that the company is focused on identifying promising startups at an earlier stage and investing heavily in the semiconductor industry. If SoftBank is successful in these endeavors, it could help to restore the company’s reputation as a savvy tech investor and position it for long-term success in the industry.